FAQ & Code

This is a compendium of frequently asked questions on Pine. Answers often give code examples or link to the best sources on the subject.

Do not make the mistake of assuming this is strictly beginner’s material; some of the questions and answers explore advanced techniques.

Reusing this code: You are welcome to reuse this code in your scripts. No permission is required from PineCoders. Credits are appreciated.

Table of Contents

- Built-in variables

- Built-in functions

- Operators

- Math

- Indicators (a.k.a. studies)

- Strategies

- Plotting

- Text

- Labels and Lines

- Arrays

- Time, dates and Sessions

- Other Timeframes (MTF)

- Alerts

- Editor

- Techniques

- Debugging

BUILT-IN VARIABLES

What is the variable name for the current price?

The close variable holds both the price at the close of historical bars and the current price when an indicator is running on the realtime bar. If the script is a strategy running on the realtime bar, by default it runs only at the bar’s close. If the calc_on_every_tick parameter of the strategy() declaration statement is set to true, the strategy will behave as an indicator and run on every price change of the realtime bar.

To access the close of the previous bar’s close in Pine, use close[1]. In Pine, brackets are used as the history-referencing operator.

What is the code for an up bar?

upBar = close > open

Once you have defined the upBar variable, if you wanted a boolean variable to be true when the last three bars were up bars, you could write:

threeUpBars = upBar and upBar[1] and upBar[2]

You could also achieve the same using:

threeUpBars = sum(upBar ? 1 : 0, 3) == 3

which produces a value of 1 every time the upBar boolean variable is true, and adds the number of those values for the last 3 bars. When that rolling sum equals 3, threeUpBars is true.

Note that the variable name

3UpBarswould have caused a compilation error. It is not legal in Pine as it begins with a digit.

If you wanted to have a condition true when there were 7 or more up bars in the last 10, you could use:

sevenUpBarsInLastTen = sum(upBar ? 1 : 0, 10) >= 7

If you need to define up and down bars and want to account for all possibilities, make sure one of those definitions allows for the case where open and close are equal:

upBar = close > open

dnBar = not upBar

In this case, when close == open, upBar will be false and dnBar true.

If you want to go one step further in defining what constitutes an up and down bar, you can use these functions. They are useful on smaller timeframes when price does not move during bars. Note that these functions taken together do not account for all possible situations, as none of them will return true when price does not move during a bar and the bar closes at the same level as the previous bar. These functions also use price values that are rounded to tick precision (see the following FAQ entry for the reasons why that can be useful):

f_roundedToTickOHLC() =>

[round_to_mintick(open), round_to_mintick(high), round_to_mintick(low), round_to_mintick(close)]

[o, h, l, c] = f_roundedToTickOHLC()

// ————— Function returning true when a bar is considered to be an up bar.

f_barUp() =>

// Dependencies: `o` and `c`, which are the open and close values rounded to tick precision.

// Account for the normal "close > open" condition, but also for zero movement bars when their close is higher than previous close.

_result = c > o or (c == o and c > nz(c[1], c))

// ————— Function returning true when a bar is considered to be a down bar.

f_barDn() =>

// Dependencies: `o` and `c`, which are the open and close values rounded to tick precision.

// Account for the normal "close < open" condition, but also for zero movement bars when their close is lower than previous close.

_result = c < o or (c == o and c < nz(c[1], c))

Why do the OHLC built-ins sometimes return different values than the ones shown on the chart?

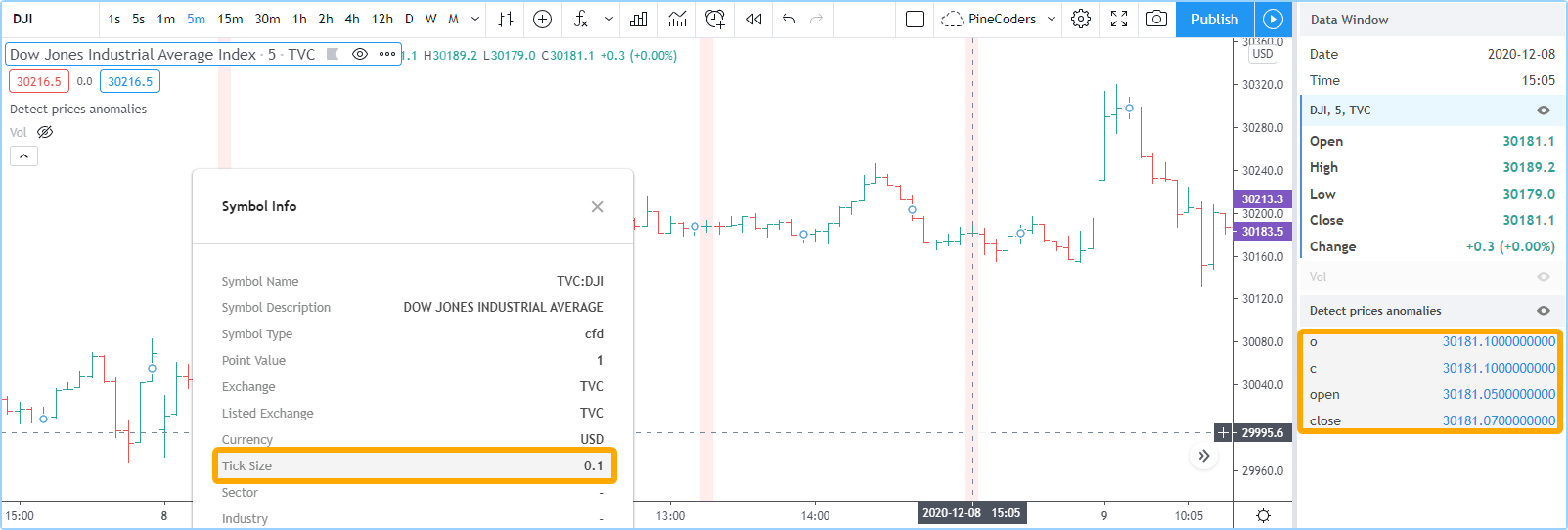

Data feeds sometimes contains prices that exceed the symbol’s tick precision. When this happens, the value returned by the close built-in may be different from the chart’s close value. Chart prices are always rounded to tick precision, but built-ins are not. This makes it possible for occurrences like the one illustrated here, where the exchange feed contains a close price of 30181.07 that is more precise than the symbol’s 0.1 tick size. In that case, the chart will show 30181.1 but the close built-in’s value will be the feed’s value of 30181.07.

The difference is subtle but such discrepancies do occur and should be taken into consideration when troubleshooting unexpected script behavior or designing precision-critical calculations. Cross detections are an example of calculations that can be affected.

One solution is to force a rounding of OHLC built-ins and use the rounded values in further calculations, as is done in this example script, which spots discrepancies between the evaluation of the open == close conditional expression with and without rounded values:

//@version=4

study("My Script", overlay = true, precision = 10)

o = round_to_mintick(open)

c = round_to_mintick(close)

bgcolor(o == c and open != close ? color.red : na)

plotchar(o, "o", "", location.top, size = size.tiny)

plotchar(c, "c", "", location.top, size = size.tiny)

plotchar(open, "open", "", location.top, size = size.tiny)

plotchar(close, "close", "", location.top, size = size.tiny)

You can also use this version of the function which returns rounded OHLC values in a single call:

//@version=4

study("", precision = 8)

f_roundedToTickOHLC() =>

[round_to_mintick(open), round_to_mintick(high), round_to_mintick(low), round_to_mintick(close)]

f_color(_v1, _v2) => _v1 != _v2 ? color.red : color.blue

[o, h, l, c] = f_roundedToTickOHLC()

plotchar(o, "o", "", location.top, f_color(o, open))

plotchar(open, "open", "", location.top, f_color(o, open))

plotchar(h, "h", "", location.top, f_color(h, high))

plotchar(high, "high", "", location.top, f_color(h, high))

plotchar(l, "l", "", location.top, f_color(l, low))

plotchar(low, "low", "", location.top, f_color(l, low))

plotchar(c, "c", "", location.top, f_color(c, close))

plotchar(close, "close", "", location.top, f_color(c, close))

bgcolor(o != open or h != high or l != low or c != close ? color.red : na)

BUILT-IN FUNCTIONS

Can I use a variable length in functions?

You can use a “series int” length (so a length that varies from bar to bar) in the following Pine functions: alma(), bb(), bbw(), cci(), change(), cmo(), cog(), correlation(), dev(), falling(), highest(), highestbars(), linreg(), lowest(), lowestbars(), mfi(), mom(), percentile_linear_interpolation(), percentile_nearest_rank(), percentrank(), rising(), roc(), sma(), stdev(), stoch(), sum(), variance(), vwma(), wma() and wpr().

The Functions Allowing Series As Length script by

alexgrover provides versions of the ema(), atr(), lsma(), variance(), covariance(), stdev() and correlation() functions.

How can I calculate values depending on variable lengths that reset on a condition?

Such calculations typically use barssince() to determine the number of bars elapsed since a condition occurs. When using variable lengths, you must pay attention to the following:

barssince()returns zero on the bar where the condition is met. Lengths, however, cannot be zero, so you need to ensure the length has a minimum value of one, which can be accomplished by usingmax(1, len).- At the beginning of a dataset, until the condition is detected a first time,

barssince()returnsna, which also cannot be used as a length, so you must protect your calculation against this, which can be done by usingnz(len). - The length must be an “int”, so it is safer to cast the result of your length’s calculation to an “int” using

int(len). - Finally, a

barssince()value of0must translate to a variable length of1, and so on, so we must add1to the value returned bybarssince().

Put together, these requirements yield code such as this one to calculate the lowest low since cond has occurred the last time:

//@version=4

study("Lowest low since condition", "", true)

cond = rising(close, 3)

lookback = int(max(1, nz(barssince(cond)) + 1))

lowestSinceCondition = lowest(lookback)

plot(lowestSinceCondition)

// Show when condition occurs.

plotchar(cond, "cond", "•", location.top, size = size.tiny)

// Display varying lookback period in Data Window.

plotchar(lookback, "lookback", "", location.top, size = size.tiny)

Why do some functions and built-ins evaluate incorrectly in if or ternary (?) blocks?

An important change to the way conditional statement blocks are evaluated was introduced with v4 of Pine. Many coders are not aware of it or do not understand its implications. This User Manual section explains the change and provides a list of exceptions for functions/built-ins which are NOT affected by the constraints. We’ll explain what’s happening here, and how to avoid the problems caused by code that does not take the change into account.

This is what’s happening:

- Starting in Pine v4, both blocks of conditional statements are no longer executed on every bar. By both blocks, we mean the part executed when the conditional expression evaluates to true, and the one (if it exists) to be executed when the expression evaluates to false.

- Many functions/built-ins need to execute on every bar to return correct results. Think of a rolling average like

sma()or a function likehighest(). If they miss values along the way, it’s easy to see how they won’t calculate properly.

This is the PineCoders “If Law”:

Whenever an if or ternary’s (

?) conditional expression can be evaluated differently bar to bar, all functions used in the conditional statement’s blocks not in the list of exceptions need to be pre-evaluated prior to entry in the if statement, to ensure they are executed on each bar.

While this can easily be forgotten in the creative excitement of coding your latest idea, you will save yourself lots of pain by understanding and remembering this. This is a major change from previous versions of Pine. It has far-reaching consequences and not structuring code along these lines can have particularly pernicious consequences because the resulting incorrect behavior is sometimes discrete (appearing only here and there) and random.

To avoid problems, you need to be on the lookout for 2 conditions:

Condition A

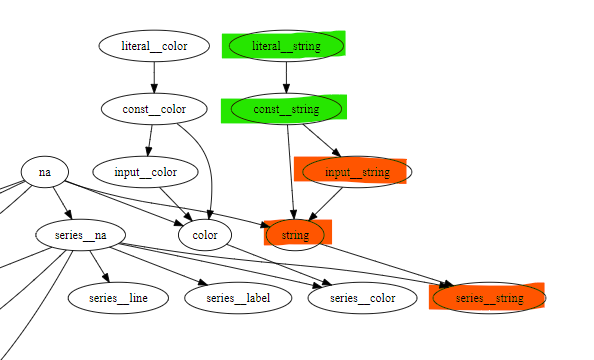

A conditional expression that can only be evaluated with incoming, new bar information (i.e., using series variables like close). This excludes expressions using values of literal, const, input or simple forms because they do not change during the script’s execution, and so when you use them, the same block in the if statement is guaranteed to execute on every bar. Read this if you are not familiar with Pine forms and types.

Condition B

When condition A is met, and the if block(s) contain(s) functions or built-ins NOT in the list of exceptions, i.e., which require evaluation on every bar to return a correct result, then condition B is also met.

This is an example where an apparently inoffensive built-in like vwap is used in a ternary. vwap is not in the list of exceptions, and so when condition A is realized, it will require evaluation prior to entry in the if block. You can flip between 3 modes: #1 where condition A is fulfilled and #2 and #3 where it is not. You will see how the unshielded value (“upVwap2” in the thick line) will produce incorrect results when mode 1 is used.

//@version=4

study("When to pre-evaluate functions/built-ins", "", true)

CN1 = "1. Condition A is true because evaluation varies bar to bar"

CN2 = "2. Condition A is false because `timeframe.multiplier` does not vary during the script's execution"

CN3 = "3. Condition A is false because an input does not vary during the script's execution"

useCond = input(CN1, "Test on conditional expression:", options = [CN1, CN2, CN3])

p = 10

// ————— Conditional expression 1: CAUTION!

// Can lead to execution of either `if` block because:

// uses *series* variables, so result changes bar to bar.

// (Condition A is fulfilled).

cond1 = close > open

// ————— Conditional expression 2: NO WORRIES

// Guarantees execution of same `if` block on every bar because:

// uses *simple* variable, so result does NOT change bar to bar

// because it is known before the script executes and does not change.

// (Condition A is NOT fulfilled).

cond2 = timeframe.multiplier > 0

// ————— Conditional expression 3: NO WORRIES

// Guarantees execution of same `if` block on every bar because:

// uses *input* variable, so result does NOT change bar to bar

// because it is known before the script execcutes and does not change.

// (Condition A is NOT fulfilled).

cond3 = input(true)

cond = useCond == CN1 ? cond1 : useCond == CN2 ? cond2 : cond3

// Built-in used in 'if' blocks that is not part of the exception list,

// and so will require forced evaluation on every bar prior to entry in 'if' statement.

// (Condition B will be true when Condition A is also true)

v = vwap

// Shielded against condition B because vwap is pre-evaluted.

upVwap = sum(cond ? v : 0, p) / sum(cond ? 1 : 0, p)

// NOT shielded against condition B because vwap is NOT pre-evaluted.

upVwap2 = sum(cond ? vwap : 0, p) / sum(cond ? 1 : 0, p)

plot(upVwap, "upVwap", color.fuchsia)

plot(upVwap2, "upVwap2", color.fuchsia, 8, transp = 80)

bgcolor(upVwap != upVwap2 ? color.silver : na)

OPERATORS

What’s the difference between ==, = and :=?

== is a comparison operator used to test for true/false conditions.

= is used to declare and initialize variables.

:= is used to assign values to variables after initialization, transforming them into mutable variables.

//@version=3

study("")

a = 0

b = 1

plot(a == 0 ? 1 : 2)

plot(b == 0 ? 3 : 4, color = orange)

a := 2

plot(a == 0 ? 1 : 2, color = aqua)

Can I use the := operator to assign values to past values of a series?

No. Past values in Pine series are read-only, as is the past in real life. Only the current bar instance (variableName[0]) of a series variable can be assigned a value, and when you do, the [] history-referencing operator must not be used—only the variable name.

What you can do is create a series with the values you require in it as the script is executed, bar by bar. The following code creates a new series called range with a value containing the difference between the bar’s close and open, but only when it is positive. Otherwise, the series value is zero.

range = close > open ? close - open : 0.0

In the previous example, we could determine the value to assign to the range series variable as we were going over each bar in the dataset because the condition used to assign values was known on that bar. Sometimes, you will only obtain enough information to identify the condition after a number of bars have elapsed. In such cases, a for loop must be used to go back in time and analyse past bars. This will be the case in situations where you want to identify fractals or pivots. See the Pivots Points High/Low from the User Manual, for example.

Why do some logical expressions not evaluate as expected when na values are involved?

Pine logical expressions have 3 possible values: true, false and na. Whenever an na value is used in a logical expression, the result of the logical expression will be na. Thus, contrary to what could be expected, na == na, na == true, na == false or na != true all evaluate to na. Furthermore, when a logical expression evaluates to na, the false branch of a conditional statement will be executed. This may lead to unexpected behavior and entails that special cases must be accounted for if you want your code to handle all possible logical expression results according to your expectations.

Let’s take a case where, while we are debugging code, we want to compare two variables that should always have the same value, but where one of the variables or both can have an na value. When that is the case, neither a == b nor a != b will return true or false, as they both return na.

When we undestand this, we can see why the first bgcolor() line in the following code shows no background. While you could expect the a != b logical expression to be true and thus the background to appear lime because the value of variable a does not equal the value of b, this is not the case. Because the logical expression returns na, the false branch of the ternary is executed and no color is plotted in the background.

The second bgcolor() line will produce the behavior we expect. You will see this if you comment out the first one and uncomment this second line. The other lines show different variations of the concept.

//@version=4

study("")

int a = 1

int b = na

bgcolor(a != b ? color.lime : na, transp = 20) // na, so goes to false branch.

// bgcolor(a == b ? na : color.red, transp = 20) // na, so goes to false branch.

// bgcolor(na((a != b)) ? color.orange : na, transp = 20) // true, so works.

// bgcolor(a != b or na(a != b) ? color.fuchsia : na, transp = 20) // true, so works.

This code shows a more practical example using a test for pivots.

//@version=4

study("Logical expressions evaluate to true, false or na", "", precision=10)

// Truncated Stoch RSI built-in

smoothK = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

src = input(close, title="RSI Source")

capMin = input(false)

showEquals = input(true)

rsi1 = rsi(src, lengthRSI)

kCapped = max(10e-10, sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK))

kNormal = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

k = capMin ? kCapped : kNormal

plot(k, color=color.blue)

hline(0, "", color.gray)

pLo = pivotlow(k, 1, 1)

// Usual way which doesn't work when a pivot occurs at value 0.

var usualSignal = 0.

if pLo

usualSignal := 85

else

// Note that this else clause catches all non-true values, so both 0 (false) AND na values.

usualSignal := 15

plot(usualSignal, "Usual Signal", color.teal, 10, transp = 10)

// Bad way because we're comparing the pivot's value to 1 (true) and 0 (false),

// so the logical expressions will only be true if a pivot occurs at those values, which is almost never.

var badSignal = 0.

if pLo == true

// This conditions only catches pivots when they occur at value == 1, so almost never happens.

badSignal := 85

else

// This conditions only catches pivots when they occur at value == 0, so almost never happens.

if pLo == false

badSignal := 15

else

// This catches all the rest of conditions, which is almost always.

badSignal := 50

plot(badSignal, "Bad Signal", color.purple, 10, transp = 60)

// Proper way to test so that we do not miss any pivots.

var goodSignal = 0.

if not na(pLo)

// This identifies all pivot occurrences (including at value == 0) because it tests for values that are not na.

goodSignal := 85

else

goodSignal := 15

plot(goodSignal, "Good Signal", color.orange, 2, transp = 0)

// Our background color also misses pivots when they occur at value == 0.

bgcolor(pLo ? color.red : na, transp = 70)

// This line identifies pivots which occur at value == 0.

plotchar(not na(pLo) and pLo == 0., "", "•", location.top, color.fuchsia, 0, text = "Missed\nlow pivot", textcolor = color.new(color.red, 0), size = size.small)

// Debugging plots for Data Window.

plotchar(pLo, "pLo", "", location.top)

plotchar(pLo == true, "pLo == true", "", location.top)

plotchar(pLo == false, "pLo == false", "", location.top)

plotchar(na(pLo), "na(pLo)", "", location.top)

plotchar(true, "true", "", location.top)

plotchar(false, "false", "", location.top)

If you are comparing two signals and want to be sure they produce the same values all the time, including na values, you can use code like this to make sure they are rigorously the same on all bars. It compares the value of rsi(close, 14) to an external input:

//@version=4

study("")

// ——— For verification, allows comparison to user rating from another version of "Technicals".

i_comparedSignal = input(close, "Debugging: Compare to")

f_nzEqEq(_c1, _c2) => nz(_c1, 10e15) == nz(_c2, 10e15)

signal = rsi(close, 14)

var error = false

error := error or not f_nzEqEq(signal, i_comparedSignal)

bgcolor(error ? color.red : na)

MATH

How can I round a number to x increments?

//@version=4

study("Round fraction")

i_val = input(0.75, "Value to round", step = 0.01)

i_to = input(0.75, "Increment", step = 0.01)

f_roundTo(_val, _to) =>

// Kudos to @veryevilone for the idea.

round(_val / _to) * _to

plot(f_roundTo(i_val, i_to))

plot(f_roundTo(close, i_to))

How can I control the number of decimals used in displaying my script’s values?

Rounding behavior in displayed values is controlled by the combination of your script’s precision= and format= arguments in its study() or strategy() declaration statement. See the Reference and User Manual on the subject. The default will use the precision of the price scale. To increase it, you will need to specify a precision= argument greater than that of the price scale.

How can I control the precision of values used in my calculations?

You can use the round(number, precision) form of round() to round values. You can also round values to tick precision using our function from this entry.

How can I round down the number of decimals of a value?

This function allows you to truncate the number of decimal places of a float value. f_roundDown(1.218, 2) will yield “1.21”, and f_roundDown(-1.218, 2) will yield “-1.22”:

f_roundDown(_number, _decimals) =>

(floor(_number * pow(10, _decimals))) / pow(10, _decimals)

Thanks to Daveatt for the function.

How can I round to ticks?

Use round_to_mintick(). If you need to round a string representation of a number, use tostring(x, format.mintick).

How can I abbreviate large values?

To abbreviate large values like volume (e.g., 1,222,333.0 ► “1.222M”), you can:

- Use

format = format.volumeinstudy()orstrategy(). This affects all values displayed by the script. - Use

tostring(x, format.volume)to abbreviate specific values. - Use a function such as this

f_abbreviateValue(_v, _precision), which allows you to specify a custom precision, abbreviates up to trillions, and provides subtle spacing between the value and the letter denoting the magnitude:

//@version=4

study("")

// ————— Function to format large values.

f_abbreviateValue(_v, _precision) => // Thx Alex P.!

// float _v : value to format.

// string _precision: format suffix for precision ("" for none, ".00" for two digits, etc.)

float _digits = log10(abs(_v))

string _precisionFormat = "#" + _precision

string _return = if _digits > 12

tostring(_v / 1e12, _precisionFormat + " T")

else if _digits > 9

tostring(_v / 1e9, _precisionFormat + " B")

else if _digits > 6

tostring(_v / 1e6, _precisionFormat + " M")

else if _digits > 3

tostring(_v / 1e3, _precisionFormat + " K")

else

tostring(_v, "#" + _precisionFormat)

f_print(_text) => var table _t = table.new(position.middle_right, 1, 1), table.cell(_t, 0, 0, _text, bgcolor = color.yellow)

f_print(f_abbreviateValue(volume, ".00"))

How can I calculate using pips?

Use this function to return the correct pip value for pips on Forex symbols:

pip() => syminfo.mintick * (syminfo.type == "forex" ? 10 : 1)

How do I calculate averages?

- If the values you need to average are in distinct variables, you can use

avg(val1, val2)with up to ten values. - If you need the average between a single bar’s prices, see

hl2,hlc3andohlc4. - To average the last n values in a series, you can use

sma(series, n). - Finally, you can also use an array to build a custom set of values and then use

array.avg()to average them. See the Pine User Manual on arrays for more information.

How can I calculate an average only when a certain condition is true?

This script shows how to calculate a conditional average using three different methods.

How can I generate a random number?

See random().

How can I evaluate a filter I am planning to use?

See the Filter Information Box - PineCoders FAQ script by alexgrover. You can add your filter code to it; the script will then evaluate its impulse response and display your filter’s characteristics.

INDICATORS

Can I use a Pine script with the TradingView screener?

Not for the moment. The TV screener only works with the filters already included in it. A search of the Public Library on “screener” will return a few examples of scripts that use security() to screen from pre-determined and limited lists of symbols.

Can I create an indicator that plots like the built-in Volume or Volume Profile indicators?

No. A few of the built-in indicators TradingView publishes are written in JavaScript because their behavior cannot be replicated in Pine. The Volume and Volume Profile indicators are among those. This Stack Overflow answer provides an imperfect workaround.

How can I use one script’s output as an input into another?

Use the following in your code:

ExternalIndicator = input(close, "External Indicator")

From the script’s Inputs you will then be able to select a plot from another indicator if it present on your chart. You can use only one such statement in your script. If you use more than one, the other indicator plots will not be visible from the Inputs dropdown. You cannot use this technique in strategies.

See how our Signal for Backtesting-Trading Engine can be integrated as an input to our Backtesting-Trading Engine.

Is it possible to export indicator data to a file?

Yes, through the Export chart data… item in the burger menu at the top left of your chart. The exported CSV data will include time and OHLC data, plus any plots your script is plotting. It is thus a matter of plotting the information you want to appear in the CSV file. When plotting values outside the scale of your indicator, or if you simply don’t want the plots to show, you may find it useful to use the plot()’s function display = parameter so that it doesn’t disrupt your script’s scale. The name of the plot will appear in the CSV column header:

plot(close*0.5, "No Display", display = display.none)

Note that you can export strategy data using the same method.

Can my script place something on the chart when it is running from a pane?

The only thing that can be changed on the chart from within a pane is the color of the bars. See the barcolor() function.

STRATEGIES

Why are my orders executed on the bar following my triggers?

TradingView backtesting evaluates conditions at the close of historical bars. When a condition triggers, the associated order is executed at the open of the next bar, unless process_orders_on_close=true in the strategy() declaration statement, in which case the broker emulator will try to execute orders at the bar’s close.

In the real-time bar, orders may be executed on the tick (price change) following detection of a condition. While this may seem appealing, it is important to realize that if you use calc_on_every_tick=true in the strategy() declaration statement to make your strategy work this way, you are going to be running a different strategy than the one you tested on historical bars. See the Strategies page of the User Manual for more information.

How do I implement date range filtering in strategies?

This code allows coders to restrict specific calculations in a script to user-selected from/to dates. If you need to also filter on specific times, use How To Set Backtest Time Ranges by allanster.

//@version=4

study("Date Filtering", "", true)

i_dateFilter = input(false, "═════ Date Range Filtering ═════")

i_fromYear = input(1900, "From Year", minval = 1900)

i_fromMonth = input(1, "From Month", minval = 1, maxval = 12)

i_fromDay = input(1, "From Day", minval = 1, maxval = 31)

i_toYear = input(2999, "To Year", minval = 1900)

i_toMonth = input(1, "To Month", minval = 1, maxval = 12)

i_toDay = input(1, "To Day", minval = 1, maxval = 31)

fromDate = timestamp(i_fromYear, i_fromMonth, i_fromDay, 00, 00)

toDate = timestamp(i_toYear, i_toMonth, i_toDay, 23, 59)

f_tradeDateIsAllowed() => not i_dateFilter or (time >= fromDate and time <= toDate)

enterLong = f_tradeDateIsAllowed() and crossover(rsi(close, 14), 50)

plotchar(enterLong, "enterLong", "▲", location.belowbar, color.lime, size = size.tiny)

Note that with this code snippet, date filtering can quickly be enabled/disabled using a checkbox. This way, traders don’t have to reset dates when filtering is no longer needed; they can simply uncheck the box.

Why is backtesting on Heikin Ashi and other non-standard charts not recommended?

Because non-standard chart types use non-standard prices which produce non-standard results. See our Backtesting on Non-Standard Charts: Caution! - PineCoders FAQ indicator and its description for a more complete explanation.

The TradingView Help Center also has a good article on the subject.

How can I save the entry price in a strategy?

Here are two ways you can go about it:

//@version=4

// Mod of original code at https://www.tradingview.com/script/bHTnipgY-HOWTO-Plot-Entry-Price/

strategy("Plot Entry Price", "", true)

longCondition = crossover(sma(close, 14), sma(close, 28))

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = crossunder(sma(close, 14), sma(close, 28))

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

// ————— Method 1: wait until bar following order and use its open.

var float entryPrice = na

if longCondition[1] or shortCondition[1]

entryPrice := open

plot(entryPrice, "Method 1", color.orange, 3, plot.style_circles)

// ————— Method 2: use built-in variable.

plot(strategy.position_avg_price, "Method 2", color.gray, 1, plot.style_circles, transp = 0)

Can my strategy place orders with TradingView brokers?

Not directly from the TradingView platform, as can be done manually; only manual orders can be placed with brokers integrated in TradingView. It is, however, possible for Pine scripts to place orders in markets for automated trading, including through some of the brokers integrated in TradingView, but to reach them you will need to use a third party execution engine to relay orders. See our next entry on the subject.

Can my Pine strategy or study place automated orders in markets?

Yes. By generating alert events and sending them to third party execution engines, orders can be relayed from a script to the execution engine, and then to a broker or exchange.

The markets you can reach from a Pine script are limited by the execution engine you will use. There is a healthy ecosystem of execution engines able to accept incoming TradingView alerts containing orders intended for markets. Our Resources page lists a few of them. While they do not cover the entirety of world markets, you will be able to reach quite a few, conventional or crypto.

These are the steps you will typically need to go through to build a working automated trading system from a Pine study/strategy:

- Decide which third-party execution you will be using. This will have an impact on:

- The markets you can reach.

- The syntax required in alert messages to communicate orders.

- The conduit you will be using to send the alerts to the execution engine (webhooks, email, etc.).

- You will need an account with the execution engine and with the broker/exchange where your oders will be executed.

- In your study or strategy, create alert events that will trigger when orders must be sent, along with the required order-placement syntax.

- From your TV charts, create an alert for each symbol you want to run your system on, and configure it so that it is sent through the conduit required by your particular execution engine.

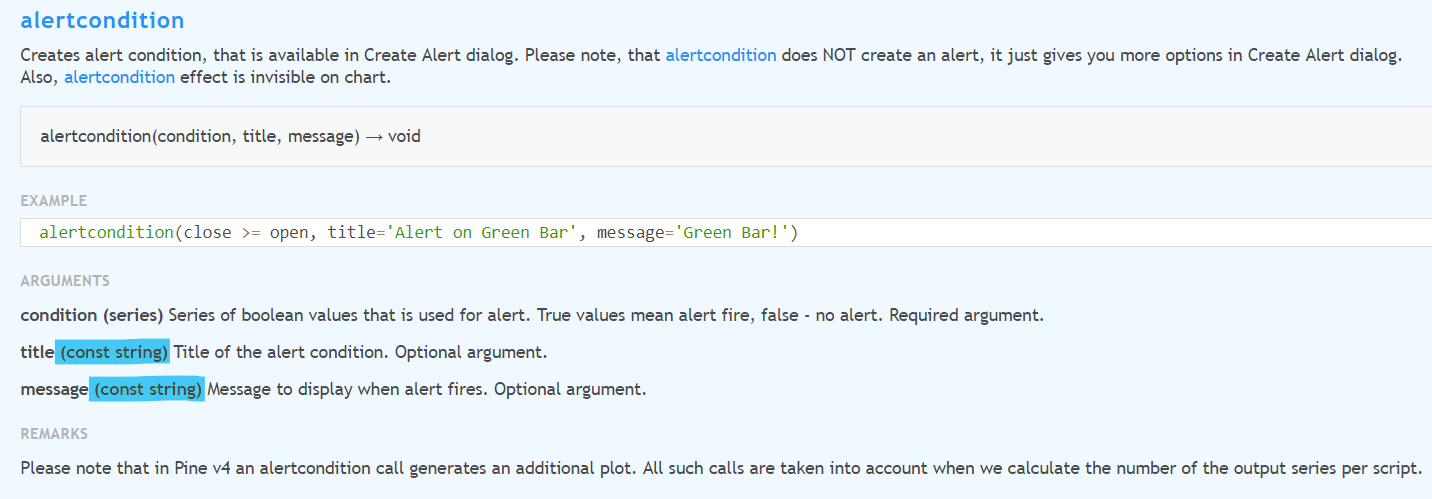

For information on creating alert events from studies, see the Pine User Manual on alertcondition().

To create alert events from strategies, see the Help Center page on strategy alerts.

See this Help Center page to learn how to create alerts from the charts UI.

Can I connect my strategies to my paper trading account?

Strategies cannot generate orders for a TradingView paper trading account. If you hold a paper account with a broker or exchange, it may be possible to connect your strategies to it via alerts and a third-party execution engine. See this FAQ entry.

How can I implement a time delay between orders?

Here, we set up the script to allow the user to turn the delay on and off, and to set the duration of the delay.

The f_tfInMinutes() and f_timeFrom(_from, _qty, _units) are lifted from our

Time Offset Calculation Framework:

//@version=4

strategy("Strat with time delay", overlay=true)

i_qtyTimeUnits = - input(20, "Quantity", inline = "Delay", minval = 0, tooltip = "Use 0 for no delay")

i_timeUnits = input("minutes", "", inline = "Delay", options = ["seconds", "minutes", "hours", "days", "months", "years"])

// ————— Converts current chart timeframe into a float minutes value.

f_tfInMinutes() =>

_tfInMinutes = timeframe.multiplier * (

timeframe.isseconds ? 1. / 60 :

timeframe.isminutes ? 1. :

timeframe.isdaily ? 60. * 24 :

timeframe.isweekly ? 60. * 24 * 7 :

timeframe.ismonthly ? 60. * 24 * 30.4375 : na)

// ————— Calculates a +/- time offset in variable units from the current bar's time or from the current time.

// WARNING:

// This functions does not solve the challenge of taking into account irregular gaps between bars when calculating time offsets.

// Optimal behavior occurs when there are no missing bars at the chart resolution between the current bar and the calculated time for the offset.

// Holidays, no-trade periods or other irregularities causing missing bars will produce unpredictable results.

f_timeFrom(_from, _qty, _units) =>

// _from : starting time from where the offset is calculated: "bar" to start from the bar's starting time, "close" to start from the bar's closing time, "now" to start from the current time.

// _qty : the +/- qty of _units of offset required. A "series float" can be used but it will be cast to a "series int".

// _units : string containing one of the seven allowed time units: "chart" (chart's resolution), "seconds", "minutes", "hours", "days", "months", "years".

// Dependency: f_resInMinutes().

int _timeFrom = na

// Remove any "s" letter in the _units argument, so we don't need to compare singular and plural unit names.

_unit = str.replace_all(_units, "s", "")

// Determine if we will calculate offset from the bar's time or from current time.

_t = _from == "bar" ? time : _from == "close" ? time_close : timenow

// Calculate time at offset.

if _units == "chart"

// Offset in chart res multiples.

_timeFrom := int(_t + (f_tfInMinutes() * 60 * 1000 * _qty))

else

// Add the required _qty of time _units to the _from starting time.

_year = year(_t) + (_unit == "year" ? int(_qty) : 0)

_month = month(_t) + (_unit == "month" ? int(_qty) : 0)

_day = dayofmonth(_t) + (_unit == "day" ? int(_qty) : 0)

_hour = hour(_t) + (_unit == "hour" ? int(_qty) : 0)

_minute = minute(_t) + (_unit == "minute" ? int(_qty) : 0)

_second = second(_t) + (_unit == "econd" ? int(_qty) : 0)

// Return the resulting time in ms Unix time format.

_timeFrom := timestamp(_year, _month, _day, _hour, _minute, _second)

// Entry conditions.

ma = sma(close, 100)

goLong = close > ma

goShort = close < ma

// Time delay filter

var float lastTradeTime = na

if nz(change(strategy.position_size), time) != 0

// An order has been executed; save the bar's time.

lastTradeTime := time

// If user has chosen to do so, wait `i_qtyTimeUnits` `i_timeUnits` between orders

delayElapsed = f_timeFrom("bar", i_qtyTimeUnits, i_timeUnits) >= lastTradeTime

if goLong and delayElapsed

strategy.entry("Long", strategy.long, comment="Long")

if goShort and delayElapsed

strategy.entry("Short", strategy.short, comment="Short")

plot(ma, "MA", goLong ? color.lime : color.red)

plotchar(delayElapsed, "delayElapsed", "•", location.top, size = size.tiny)

How can I calculate custom statistics in a strategy?

When you issue orders in a strategy by using any of the strategy.*() function calls, you do the equivalent of sending an order to your broker/exchange. The broker emulator takes over the management of those orders and simulates their execution when the conditions in the orders are fulfilled. In order to detect the execution of those orders, you can use changes in the built-in variables such as strategy.opentrades and strategy.closedtrades.

This script demonstrates how to accomplish this. The first part calculates the usual conditions required to manage trade orders and issues those orders. The second part detects order fill events and calculates various statistics from them. The script also demonstrates how to calculate position sizes using a fixed percentage of the equity and the risk incurred when entering the trade, which is defined as the distance to the entry stop. The default strategy parameters also use commission. All strategies should account for some fees, either in the form of commission or in slippage (which can be used to simulate spreads), as nobody usually trades for free, and ignoring trading fees is a common mistake which can be costly:

//@version=4

strategy("Custom strat stats", "", true, initial_capital = 10000, commission_type = strategy.commission.percent, commission_value = 0.075, max_bars_back = 1000)

float i_maxPctRisk = input(1.0, "Maximum %Risk On Equity Per Trade", minval = 0., maxval = 100., step = 0.25) / 100.

// ———————————————————— Strat calcs.

// ————— Function rounding _price to tick precision.

f_roundToTick(_price) => round(_price / syminfo.mintick) * syminfo.mintick

// ————— Entries on MA crosses when equity is not depleted.

float c = f_roundToTick(close)

float maF = f_roundToTick(sma(hlc3, 10))

float maS = f_roundToTick(sma(hlc3, 60))

bool enterLong = crossover( maF, maS) and strategy.equity > 0

bool enterShort = crossunder(maF, maS) and strategy.equity > 0

// ————— Exits on breach of hi/lo channel.

float stopLong = lowest(20)[1]

float stopShort = highest(20)[1]

// ————— Position sizing.

// Position size is calculated so the trade's risk equals the user-selected max risk of equity allowed per trade.

// This way, positions sizes throttle with equity variations, but always incur the same % risk on equity.

// Note that we are estimating here. We do not yet know the actual fill price because the order will only be executed at the open of the next bar.

float riskOnEntry = abs(c - (enterLong ? stopLong : enterShort ? stopShort : na))

float positionSize = strategy.equity * i_maxPctRisk / riskOnEntry

// ————— Orders to broker emulator.

// Entries, which may include reversals. Don't enter on first bars if no stop can be calculated yet.

strategy.entry("Long", strategy.long, qty = positionSize, comment ="►Long", when = enterLong and not na(stopLong))

strategy.entry("Short", strategy.short, qty = positionSize, comment ="►Short", when = enterShort and not na(stopShort))

// Exits. Each successive call modifies the existing order, so the current stop value is always used.

strategy.exit("◄Long", "Long", stop = stopLong)

strategy.exit("◄Short", "Short", stop = stopShort)

// ———————————————————— Custom stat calcs.

// From this point on, we only rely on changes to `strategy.*` variables to detect the execution of orders.

// ————— Detection of order fill events.

bool tradeWasClosed = change(strategy.closedtrades)

bool tradeWasEntered = change(strategy.opentrades) > 0 or (strategy.opentrades > 0 and tradeWasClosed)

bool tradeIsActive = strategy.opentrades != 0

// ————— Number of trades entered.

float tradesEntered = cum(tradeWasEntered ? 1 : 0)

// ————— Percentage of bars we are in a trade.

float barsInTradePct = 100 * cum(tradeIsActive ? 1 : 0) / bar_index

// ————— Avg position size.

float avgPositionSize = cum(nz(positionSize))[1] / tradesEntered

// ————— Avg entry stop in %.

float stopPct = riskOnEntry / c

float avgEntryStopPct = 100 * cum(nz(stopPct)) / tradesEntered

// ————— Avg distance to stop during trades in %.

var float[] distancesToStopInPctDuringTrade = array.new_float(0)

var float[] distancesToStopInPct = array.new_float(0)

float stop = strategy.position_size > 0 ? stopLong : strategy.position_size < 0 ? stopShort : na

float distanceToStopInPct = 100 * abs(stop - c) / c

// Keep track of distances to stop during trades.

if tradeWasEntered

// Start with an empty array for each trade.

array.clear(distancesToStopInPctDuringTrade)

else if tradeIsActive

// Add a new distance for each bar in the trade.

array.push(distancesToStopInPctDuringTrade, distanceToStopInPct)

else if tradeWasClosed

// At the end of a trade, save the avg distance for that trade in our global values for all trades.

array.push(distancesToStopInPct, array.avg(distancesToStopInPctDuringTrade))

// Avg distance for all trades.

float avgDistancesToStop = array.avg(distancesToStopInPct)

// ———————————————————— Plots

// ————— Chart plots.

plot(maF, "MA Fast")

plot(maS, "MA Slow", color.silver)

plot(stop, "Stop", color.fuchsia, 1, plot.style_circles)

bgcolor(strategy.position_size > 0 ? color.teal : strategy.position_size < 0 ? color.maroon : na, transp = 95)

// ————— Data Window plots.

plotchar(na, "════════ Risk", "", location.top, size = size.tiny)

plotchar(strategy.equity, "Equity", "", location.top, size = size.tiny)

plotchar(strategy.equity * i_maxPctRisk, "Max value of equity to risk", "", location.top, size = size.tiny)

plotchar(riskOnEntry, "Risk On Entry", "", location.top, size = size.tiny)

plotchar(positionSize, "Position Size", "", location.top, size = size.tiny)

plotchar(0, "════════ Stats", "", location.top, size = size.tiny)

plotchar(tradesEntered, "tradesEntered", "", location.top, size = size.tiny)

plotchar(barsInTradePct, "barsInTradePct", "", location.top, size = size.tiny)

plotchar(avgPositionSize, "avgPositionSize", "", location.top, size = size.tiny)

plotchar(avgEntryStopPct, "avgEntryStopPct", "", location.top, size = size.tiny)

plotchar(avgDistancesToStop, "avgDistancesToStop", "", location.top, size = size.tiny)

plotchar(na, "════════ Misc.", "", location.top, size = size.tiny)

plotchar(strategy.opentrades, "strategy.opentrades", "", location.top, size = size.tiny)

plotchar(strategy.closedtrades, "strategy.closedtrades", "", location.top, size = size.tiny)

plotchar(strategy.position_size, "strategy.position_size", "", location.top, size = size.tiny)

plotchar(positionSize, "positionSize", "", location.top, size = size.tiny)

plotchar(positionSize * close, "Position's Value", "", location.top, size = size.tiny)

plotchar(close, "Estimated entry Price", "", location.top, size = size.tiny)

p = riskOnEntry / close

plotchar(p, "p", "", location.top, size = size.tiny)

plotchar(strategy.equity * i_maxPctRisk, "strategy.equity * i_maxPctRisk", "", location.top, size = size.tiny)

r = positionSize * riskOnEntry

plotchar(r, "r", "", location.top, size = size.tiny)

plotchar(enterLong, "enterLong", "", location.top, size = size.tiny)

plotchar(enterShort, "enterShort", "", location.top, size = size.tiny)

plotchar(tradeWasClosed, "tradeWasClosed", "—", location.bottom, size = size.tiny)

plotchar(tradeWasEntered, "tradeWasEntered", "+", location.top, size = size.tiny)

Why can’t I backtest deeper into history?

The depth of history is measured in bars—not time. The quantity of bars on charts varies with your type of account:

- 5K bars for Basic accounts.

- 10K bars for Pro and Pro+ accounts.

- 20K bars for Premium accounts.

At 20K bars on 1min charts, the depth measured in time will vary with the quantity of 1min bars in the dataset. 24x7 markets with pretty much all 1min bars present will yield ~17 days of history. Less densely populated 1min charts like GOOGL will yield ~72 days.

You can use this script to test how deep your history reaches:

//@version=4

study("Days of history")

var begin = time

days = (time - begin) / (24 * 60 * 60 * 1000)

plot(days)

f_print(_text) => var _label = label.new(bar_index, na, _text, xloc.bar_index, yloc.price, color(na), label.style_label_up, color.gray, size.large, text.align_left), label.set_xy(_label, bar_index, days), label.set_text(_label, _text)

f_print(tostring(days, "#.0 days\n") + tostring(bar_index + 1, "# bars"))

How can I implement a time delay between orders?

By saving the time when trades occur, and then determining, as bars elapse since the last order execution, if the required time delay has passed. The broker emulator doesn’t notify a script when an order is executed, so we will detect their execution by monitoring changes in the strategy.position_size built-in variable. We will use our f_timeFrom() function, lifted from our Time Offset Calculation Framework publication to calculate time offsets:

//@version=4

strategy("Strat with time delay", overlay=true)

i_qtyTimeUnits = - input(1, "Delay between orders:", inline = "1", minval = 0, tooltip = "Use 0 for no delay")

i_timeUnits = input("days", "", inline = "1", options = ["seconds", "minutes", "hours", "days", "months", "years"])

// ————— Converts current chart timeframe into a float minutes value.

f_tfInMinutes() =>

_tfInMinutes = timeframe.multiplier * (

timeframe.isseconds ? 1. / 60 :

timeframe.isminutes ? 1. :

timeframe.isdaily ? 60. * 24 :

timeframe.isweekly ? 60. * 24 * 7 :

timeframe.ismonthly ? 60. * 24 * 30.4375 : na)

// ————— Calculates a +/- time offset in variable units from the current bar's time or from the current time.

// WARNING:

// This functions does not solve the challenge of taking into account irregular gaps between bars when calculating time offsets.

// Optimal behavior occurs when there are no missing bars at the chart resolution between the current bar and the calculated time for the offset.

// Holidays, no-trade periods or other irregularities causing missing bars will produce unpredictable results.

f_timeFrom(_from, _qty, _units) =>

// _from : starting time from where the offset is calculated: "bar" to start from the bar's starting time, "close" to start from the bar's closing time, "now" to start from the current time.

// _qty : the +/- qty of _units of offset required. A "series float" can be used but it will be cast to a "series int".

// _units : string containing one of the seven allowed time units: "chart" (chart's resolution), "seconds", "minutes", "hours", "days", "months", "years".

// Dependency: f_resInMinutes().

int _timeFrom = na

// Remove any "s" letter in the _units argument, so we don't need to compare singular and plural unit names.

_unit = str.replace_all(_units, "s", "")

// Determine if we will calculate offset from the bar's time or from current time.

_t = _from == "bar" ? time : _from == "close" ? time_close : timenow

// Calculate time at offset.

if _units == "chart"

// Offset in chart res multiples.

_timeFrom := int(_t + (f_tfInMinutes() * 60 * 1000 * _qty))

else

// Add the required _qty of time _units to the _from starting time.

_year = year(_t) + (_unit == "year" ? int(_qty) : 0)

_month = month(_t) + (_unit == "month" ? int(_qty) : 0)

_day = dayofmonth(_t) + (_unit == "day" ? int(_qty) : 0)

_hour = hour(_t) + (_unit == "hour" ? int(_qty) : 0)

_minute = minute(_t) + (_unit == "minute" ? int(_qty) : 0)

_second = second(_t) + (_unit == "econd" ? int(_qty) : 0)

// Return the resulting time in ms Unix time format.

_timeFrom := timestamp(_year, _month, _day, _hour, _minute, _second)

// Entry conditions.

ma = sma(close, 100)

goLong = close > ma

goShort = close < ma

// Time delay filter

var float lastTradeTime = na

if nz(change(strategy.position_size), time) != 0

// An order has been executed; save the bar's time.

lastTradeTime := time

// If user has chosen to do so, wait `i_qtyTimeUnits` `i_timeUnits` between orders

delayElapsed = f_timeFrom("bar", i_qtyTimeUnits, i_timeUnits) >= lastTradeTime

if goLong and delayElapsed

strategy.entry("Long", strategy.long, comment="Long")

if goShort and delayElapsed

strategy.entry("Short", strategy.short, comment="Short")

plot(ma, "MA", goLong ? color.lime : color.red)

// For debugging.

plotchar(delayElapsed, "delayElapsed", "•", location.top, size = size.tiny)

plotchar(barssince(goLong or goShort), "barssince(goLong or goShort)", "", location.top, size = size.tiny)

plotchar(strategy.position_avg_price, "strategy.position_avg_price", "", location.top, size = size.tiny)

PLOTTING

Why can’t I use a plot in an if or for statement?

Because it’s not allowed in Pine. You can use many different conditions to control plotting and the color of plots, but these must be controlled from within the plot() call.

If, for example, you want to plot a highlight when 2 MAs are a certain multiple of ATR away from each other, you first need to define your condition, then plot on that condition only:

//@version=4

study("Conditional plot", "", true)

// ————— Step 1: Define our condition.

ma1 = sma(close, 10)

ma2 = sma(close, 50)

plotCondition = (ma1 - ma2) > atr(14) * 3

// ————— Step 2: Plot.

// These 2 plots are plotted all the time.

plot(ma1, "Fast MA", color.fuchsia)

plot(ma2, "Slow MA", color.orange)

// Method 2a: This plots all the time as well, but because we make our color conditional,

// It only shows when our condition is true.

plot(ma1, "Highlight 2b", plotCondition ? color.fuchsia : na, 6, transp = 70)

// Method 2b: This only plots a value when our condition is true.

plot(plotCondition ? ma1 : na, "Highlight 2b", color.purple, 3, plot.style_circles)

The same limitations apply to plotchar(), plotshape() and fill().

Can I plot diagonals between two points on the chart?

Yes, using the line.new() function available in v4. See the Trendlines - JD indicator by Duyck.

How do I plot a line using start/stop criteria?

You’ll need to define your start and stop conditions and use logic to remember states and the level you want to plot.

Note the plot() call using a combination of plotting na and the style = plot.style_linebr parameter to avoid plotting a continuous line, which would produce inelegant joins between different levels.

Also note how plotchar() is used to plot debugging information revealing the states of the boolean building blocks we use in our logic. These plots are not necessary in the final product; they are used to ensure your code is doing what you expect and can save you a lot of time when you are writing your code.

//@version=4

study("Plot line from start to end condition", overlay=true)

lineExpiryBars = input(300, "Maximum bars line will plot", minval = 0)

// Stores "close" level when start condition occurs.

var savedLevel = float(na)

// True when the line needs to be plotted.

var plotLine = false

// This is where you enter your start and end conditions.

startCondition = pivothigh(close, 5, 2)

endCondition = cross(close, savedLevel)

// Determine if a line start/stop condition has occurred.

startEvent = not plotLine and startCondition

// If you do not need a limit on the length of the line, use this line instead: endEvent = plotLine and endCondition

endEvent = plotLine and (endCondition or barssince(startEvent) > lineExpiryBars)

// Start plotting or keep plotting until stop condition.

plotLine := startEvent or (plotLine and not endEvent)

if plotLine and not plotLine[1]

// We are starting to plot; save close level.

savedLevel := close

// Plot line conditionally.

plot(plotLine ? savedLevel : na, color = color.orange, style = plot.style_linebr)

// State plots revealing states of conditions.

plotchar(startCondition, "startCondition", "•", color = color.green, size=size.tiny, transp = 0)

plotchar(endCondition, "endCondition", "•", color = color.red, size=size.tiny, location = location.belowbar, transp = 0)

plotchar(startEvent, "startEvent", "►", color = color.green, size=size.tiny)

plotchar(endEvent, "endEvent", "◄", color = color.red, size=size.tiny, location = location.belowbar)

How do I plot a support or a trend line?

To plot a continuous line in Pine, you need to either:

- Look back into elapsed bars to find an occurrence that will return the same value over consecutive bars so you can plot it, or

- Find levels and save them so that you can plot them. In this case your saving mechanism will determine how many levels you can save.

- You may also use the

line.new()function available in v4. See Trendlines - JD by Duyck or Pivots MTF.

These are other examples:

How can I use colors in my indicator plots?

- See Working with colours by Kodify.

- Our Resources document has a list of color pickers to help you choose colors.

- midtownsk8rguy has a complete set of custom colors in Pine Color Magic and Chart Theme Simulator.

How do I make my indicator plot over the chart?

Use overlay=true in strategy() or study() declaration statement, e.g.,:

study("My Script", overlay = true)

If your indicator was already in a Pane before applying this change, you will need to use Add to Chart again for the change to become active.

If your script only works correctly in overlay mode and you want to prevent users from moving it to a separate pane, you can add linktoseries = true to your strategy() or study() declaration statement.

Can I use plot() calls in a for loop?

No, but you can use the v4 line.new() function in for loops.

How can I plot vertical lines on a chart?

You can use the plot.style_columns style to plot them:

//@version=4

study("", "", true, scale = scale.none)

cond = close > open

plot(cond ? 10e20 : na, style = plot.style_columns, color = color.silver, transp=85)

There is a nice v4 function to plot a vertical line in this indicator: vline() Function for Pine Script v4.0+.

How can I toggle hline() plots on and off?

showHline = input(true)

hline(50, color = showHline ? color.blue : #00000000)

How can I plot color gradients?

There are no built-in functions to generate color gradients in Pine yet. Gradients progressing horizontally across bars are much easier to implement and run faster. These are a few examples:

- Color Gradient Framework - PineCoders FAQ

- [e2] Color Gradient Function

- [RS]Color Gradient Function

- [RS]Function - RGB Color (low resolution)

To produce gradients progressing in vertical space on the same bar you will need to use a progession of plots, each with a different color. Doing so requires many plot statements and scripts using this technique will run slower than ones producing horizontal gradients. Examples:

TEXT

How can I place text on chart?

You can display text using one of the following methods:

- The

plotchar()orplotshape()functions. - Labels, when you need to display dynamic text that may v

- Tables

The plotchar() or plotshape() functions are useful to display fixed text on bars. There is no limit to the number of bars you may use those functions on, but you cannot decide at runtime which text to print. One plotchar() call can print only one character on a bar. Using plotshape()’s text parameter, you can plot a string. When you want to print two different characters on bars depending on a condition that can only be evaluated at runtime, you must use two distinct calls, each one printing on a different condition:

//@version=4

study("", "", true)

bool barUp = close > open

bool barDn = close < open

plotchar(barUp, "Up", "▲", location.top, size = size.tiny)

plotchar(barDn, "Down", "▼", location.bottom, size = size.tiny)

We need two distinct calls here because the argument to the charparameter in plotchar() must be of “input string” type, which means it can be determined by an input, but not calculated dynamically at runtime. This for example, would not work:

plotchar(barUp or barDn, "Up/Down", barUp ? "▲" : "▼", location.top, size = size.tiny)

Labels are useful when the text you want to display needs to vary from bar to bar. They are required when, for example, you want to print values on the chart such as pivot levels, which cannot be known before the script executes. There is a limit to the number of labels that can be displayed by a script. By default, it is approximately the 50 latest labels drawn by the script. You can increase that value up to 500 using the max_labels_count parameter of study() or strategy().

This shows how you can use labels to display more or less the equivalent of our first example using labels. Notice how we can now determine both the label’s text and position at runtime, so using “series string” arguments:

//@version=4

study("", "", true)

bool barUp = close > open

bool barDn = close < open

label.new(bar_index, na, barUp ? "▲" : "▼", yloc = barUp ? yloc.belowbar : yloc.abovebar, color = na, textcolor = color.blue)

Tables are useful to display text that floats in a fixed position of the indicator’s visual space, untethered to chart bars.

How can I lift plotshape() text up?

You will need to use \n followed by a special non-printing character that doesn’t get stripped out. Here we’re using U+200E. While you don’t see it in the following code’s strings, it is there and can be copy/pasted. The special Unicode character needs to be the last one in the string for text going up, and the first one when you are plotting under the bar and text is going down:

//@version=4

study("Lift text", "", true)

// Use U+200E (Decimal 8206) as a non-printing space after the last "\n".

// The line will become difficult to edit in the editor, but the character will be there.

// You can use https://unicode-table.com/en/tools/generator/ to generate a copy/pastable character.

plotshape(true, "", shape.arrowup, location.abovebar, color.green, text="A")

plotshape(true, "", shape.arrowup, location.abovebar, color.lime, text="B\n")

plotshape(true, "", shape.arrowdown, location.belowbar, color.red, text="C")

plotshape(true, "", shape.arrowdown, location.belowbar, color.maroon, text="\nD")

How can I position text on either side of a single bar?

By choosing label styles like style = label.style_label_left we can determine on which side of the bar the label is positioned. Note that since the “left”/”right” in there specifies the pointer’s position, “left” has the side effect of positioning the label on the right side of the bar. The text’s alignment in the label can be controlled using textalign = text.align_right, and finally, we can make the label’s background color transparent so we display only the text:

//@version=4

study("", "", true)

f_print(_txt, _pos, _align) => var _lbl = label.new(bar_index, highest(10)[1], _txt, xloc.bar_index, yloc.price, #00000000, _pos, color.gray, size.huge, _align), label.set_xy(_lbl, bar_index, highest(10)[1]), label.set_text(_lbl, _txt)

f_print("123\nRL", label.style_label_left, text.align_left)

f_print("123\nLR", label.style_label_right, text.align_right)

f_print("123\nC", label.style_label_center, text.align_center)

The following three labels are all positioned on the chart’s last bar:

How can I print a value at the top right of the chart?

See this example in the Pine User Manual which use a table to do it.

LABELS AND LINES

How can I draw lines or labels into the future?

For this, you will need to use xloc = xloc.bar_time in label.new() or line.new() because the default is xloc = xloc.bar_index, which does not allow positioning drawings in the future. See our Time Offset Calculation Framework for functions that will help you with this.

How can I keep only the last x labels or lines?

The easiest way is to manage an array containing the ids of the labels or lines. We will manage the array in such a way that it emulates a queue, i.e., new ids come in from the end and each time a new id comes in, we remove one from the beginning of the array, which contains the oldest id. The technique is explained in the Pine User Manual’s page on arrays, but we will use a function which allows us to save lines:

//@version=4

// We decide on an arbitray maximum of 100 labels. It could be as high as 500.

var int MAX_LABELS = 100

// Use the MAX_LABELS as the argument to `max_labels_count` because the default value would be 50 otherwise.

study("", "", true, max_labels_count = MAX_LABELS)

// Get required number of historical labels to preserve, using our constant to limit its value. If user chooses 0, no labels will display.

int i_qtyLabels = input(50, "Quantity of last labels to show", minval = 0, maxval = MAX_LABELS)

// ————— Queues a new element in an array and de-queues its first element.

f_qDq(_array, _val) =>

array.push(_array, _val)

_return = array.shift(_array)

// Create an array of label ids once. Use the user-selected quantity to determine its size.

var label[] myLabels = array.new_label(i_qtyLabels)

// On each bar:

// 1. Create a new label.

// 2. Add its id to the end of the `myLabels` array.

// 3. Remove the oldest label id from the array's beginning and return its id.

// 4. Delete the label corresponding to that id.

// Note that on early bars, until the array fills to capacity, we will be deleting ids with `na` values, but that doesn't generate runtime errors.

label.delete(f_qDq(myLabels, label.new(bar_index, high, tostring(high), style = label.style_label_down, color = color(na))))

Is it possible to draw geometric shapes?

Yes it’s possible. See these examples:

- [RS]Function - Geometric Line Drawings by RicardoSantos.

- Periodic Ellipses by alexgrover.

- Euler Cubes - Cubᵋ by fikira.

- Penrose Diagram by DayTradingOil.

- Speedometer Toolbox by rumpypumpydumpy.

- Auto Fib Speed Resistance Fans by DGT by dgtrd.

How can I color the chart’s background on a condition detected on the last bar?

See this example in the Pine User Manual’s page on tables.

ARRAYS

How can I work with arrays in Pine?

See the User Manual’s page on arrays.

How can I split a string into characters?

It can be done using str.split() and an empty string argument for the separator parameter.

This splits the string into an array of characters:

//@version=4

study("Split a string into characters")

f_print(_text) => var _label = label.new(bar_index, na, _text, xloc.bar_index, yloc.price, color(na), label.style_none, color.gray, size.large, text.align_left), label.set_xy(_label, bar_index, highest(10)[1]), label.set_text(_label, _text)

i_sourceString = input("123456789")

arrayOfCharacters = str.split(i_sourceString, "")

f_print("i_sourceString: [" + i_sourceString + "]\n")

f_print("arrayOfCharacters: " + tostring(arrayOfCharacters))

TIME, DATES AND SESSIONS

How can I get the time of the first bar in the dataset?

The following code will save the time of the dataset’s first bar. We use the fact that when we declare a variable using the var keyword, it is only initialized on the first bar. We use that here to save the value of time, which returns the time in Unix format, i.e., the number of milliseconds that have elapsed since 00:00:00 UTC, 1 January 1970:

//@version=4

study("Time at first bar")

// Get time at beginning of the dataset.

var t = time

plot(t)

How can I convert a time to a date-time string?

Use our f_timeToString() function, which accepts any timestamp in Unix format and returns the corresponding date-time in string format. This code shows four different ways of using it to get the date-time from various starting points and using a 4-day offset in the future for the last two uses demonstrated:

//@version=4

study("`f_timeToString()`")

// Get time at beginning of the dataset.

var t = time

f_timeToString(_t) =>

tostring(year(_t), "0000") + "." + tostring(month(_t), "00") + "." + tostring(dayofmonth(_t), "00") + " " +

tostring(hour(_t), "00") + ":" + tostring(minute(_t), "00") + ":" + tostring(second(_t), "00")

f_print(_txt) => var _lbl = label.new(bar_index, highest(10)[1], _txt, xloc.bar_index, yloc.price, #00000000, label.style_none, color.gray, size.large, text.align_center), label.set_xy(_lbl, bar_index, highest(10)[1]), label.set_text(_lbl, _txt)

f_print("Date-time at bar_index = 0: " + f_timeToString(t) + "\n\n\n\n\n\n")

f_print("Current Date-time: " + f_timeToString(timenow) + "\n\n\n\n")

f_print("Date-time 4 days from current time: " + f_timeToString(timestamp(year(timenow), month(timenow), dayofmonth(timenow) + 4, hour(timenow), minute(timenow), second(timenow))) + "\n\n\n")

f_print("Date-time at beginning of last bar: " + f_timeToString(time) + "\n")

f_print("Date-time at the start of the day, 4 days past the last bar's time: " + f_timeToString(timestamp(year, month, dayofmonth + 4, 00, 00, 00)))

How can I know how many days are in the current month?

Use this function by RicardoSantos.

How can I detect the chart’s last day?

To do this, we will use the security() function called at the 1D resolution and have it evaluate the barstate.islast variable on that time frame, which returns true when the bar is the last one in the dataset, even if it is not a realtime bar because the market is closed. We also allow the security() function to lookahead, otherwise it will only return true on the last bar of the chart’s resolution.

//@version=4

study("")

lastDay = security(syminfo.tickerid, "D", barstate.islast, lookahead = barmerge.lookahead_on)

bgcolor(lastDay ? color.red : na)

How can I detect if a bar’s date is today?

//@version=4

//@author=mortdiggiddy, for PineCoders

study("Detect today", "", true)

today() =>

_currentYear = year(timenow)

_currentMonth = month(timenow)

_currentDay = dayofmonth(timenow)

_result = year == _currentYear and month == _currentMonth and dayofmonth == _currentDay

bgcolor(today() ? color.gray : na)

How can I plot a value starting n months/years back?

The timestamp() function allows the use of negative argument values and will convert them into the proper date. Using a negative month value, for example, will subtract the proper number of years from the result. We use this feature here to allow us to look back an arbitrary number of months or years. A choice is given to identify the first of the target month, or go back from the current date and time.

//@version=4

study("Plot value starting n months/years back", "", true)

monthsBack = input(3, minval = 0)

yearsBack = input(0, minval = 0)

fromCurrentDateTime = input(false, "Calculate from current Date/Time instead of first of the month")

targetDate = time >= timestamp(

year(timenow) - yearsBack,

month(timenow) - monthsBack,

fromCurrentDateTime ? dayofmonth(timenow) : 1,

fromCurrentDateTime ? hour(timenow) : 0,

fromCurrentDateTime ? minute(timenow) : 0,

fromCurrentDateTime ? second(timenow) : 0)

beginMonth = not targetDate[1] and targetDate

var float valueToPlot = na

if beginMonth

valueToPlot := high

plot(valueToPlot)

bgcolor(beginMonth ? color.green : na)

How can I track highs/lows for a specific timeframe?

This code shows how to do that without using security() calls, which slow down your script. The source used to calculate the highs/lows can be selected in the script’s Inputs, as well as the period after which the high/low must be reset.

//@version=4

//@author=LucF, for PineCoders

study("Periodic hi/lo", "", true)

showHi = input(true, "Show highs")

showLo = input(true, "Show lows")

srcHi = input(high, "Source for Highs")

srcLo = input(low, "Source for Lows")

period = input("D", "Period after which hi/lo is reset", input.resolution)

var hi = 10e-10

var lo = 10e10

// When a new period begins, reset hi/lo.

hi := change(time(period)) ? srcHi : max(srcHi, hi)

lo := change(time(period)) ? srcLo : min(srcLo, lo)

plot(showHi ? hi : na, "Highs", color.blue, 3, plot.style_circles)

plot(showLo ? lo : na, "Lows", color.fuchsia, 3, plot.style_circles)

How can I track highs/lows for a specific period of time?

We use session information in the 2-parameter version of the time function to test if we are in the user-defined hours during which we must keep track of the highs/lows. A setting allows the user to choose if he wants levels not to plot outside houts. It’s the default.

//@version=4

//@author=LucF, for PineCoders

study("Session hi/lo", "", true)

noPlotOutside = input(true, "Don't plot outside of hours")

showHi = input(true, "Show highs")

showLo = input(true, "Show lows")

srcHi = input(high, "Source for Highs")

srcLo = input(low, "Source for Lows")

timeAllowed = input("1200-1500", "Allowed hours", input.session)

// Check to see if we are in allowed hours using session info on all 7 days of the week.

timeIsAllowed = time(timeframe.period, timeAllowed + ":1234567")

var hi = 10e-10

var lo = 10e10

if timeIsAllowed

// We are entering allowed hours; reset hi/lo.

if not timeIsAllowed[1]

hi := srcHi

lo := srcLo

else

// We are in allowed hours; track hi/lo.

hi := max(srcHi, hi)

lo := min(srcLo, lo)

plot(showHi and not(noPlotOutside and not timeIsAllowed)? hi : na, "Highs", color.blue, 3, plot.style_circles)

plot(showLo and not(noPlotOutside and not timeIsAllowed)? lo : na, "Lows", color.fuchsia, 3, plot.style_circles)

How can I track highs/lows between specific intrabar hours?

We use the intrabar inspection technique explained here to inspect intrabars and save the high or low if the intrabar is whithin user-defined begin and end times.

//@version=4

//@author=LucF, for PineCoders

study("Pre-market high/low", "", true)

begHour = input(7, "Beginning time (hour)")

begMinute = input(0, "Beginning time (minute)")

endHour = input(9, "End time (hour)")

endMinute = input(25, "End time (minute)")

// Lower TF we are inspecting. Cannot be in seconds and must be lower that chart's resolution.

insideRes = input("5", "Intrabar resolution used")

startMinute = (begHour * 60) + begMinute

finishMinute = (endHour * 60) + endMinute

f_highBetweenTime(_start, _finish) =>

// Returns low between specific times.

var float _return = 0.

var _reset = true

_minuteNow = (hour * 60) + minute

if _minuteNow >= _start and _minuteNow <= _finish

// We are inside period.

if _reset

// We are at first bar inside period.

_return := high

_reset := false

else

_return := max(_return, high)

else

// We are past period; enable reset for when we next enter period.

_reset := true

_return

f_lowBetweenTime(_start, _finish) =>

// Returns low between specific times.

var float _return = 10e10

var _reset = true

_minuteNow = (hour * 60) + minute

if _minuteNow >= _start and _minuteNow <= _finish

// We are inside period.

if _reset

// We are at first bar inside period.

_return := low

_reset := false

else

_return := min(_return, low)

else

// We are past period; enable reset for when we next enter period.

_reset := true

_return

highAtTime = security(syminfo.tickerid, insideRes, f_highBetweenTime(startMinute, finishMinute))

lowAtTime = security(syminfo.tickerid, insideRes, f_lowBetweenTime(startMinute, finishMinute))

plot(highAtTime, "High", color.green)

plot(lowAtTime, "Low", color.red)

How can I detect a specific date/time?

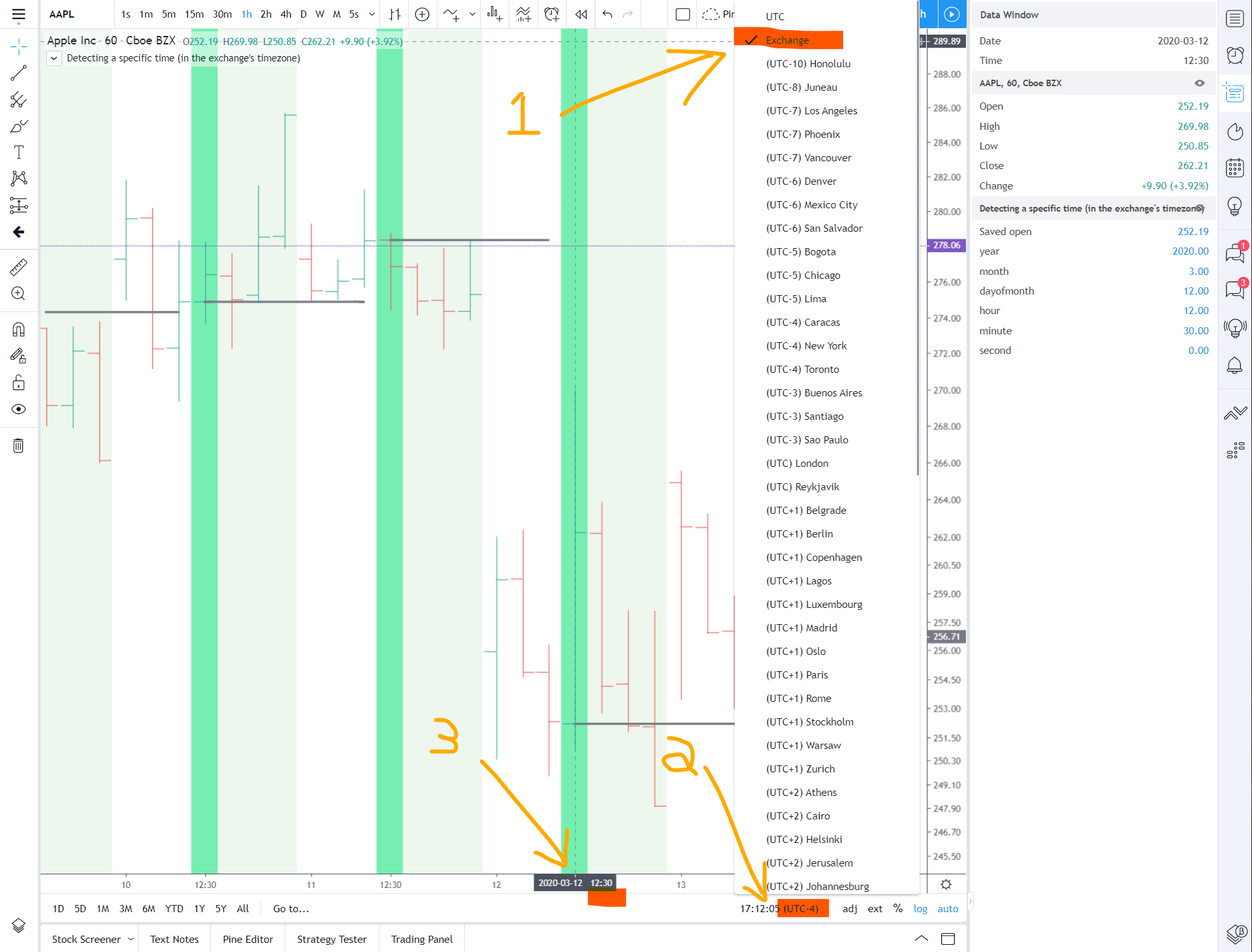

We will be using the year, month, dayofmonth, hour, minute and second built-in variables to achieve this here. All these variables return their namesake’s value at the bar the script is running on, and in the exchange’s timezone, as is documented here in the Pine User Manual. So in order for the target date/time you will enter in the script’s Settings/Inputs to match the date/time on the chart, you will need to ensure your chart’s time is set to display the exchange’s timezone, as is shown in step 1 in the chart. Once that is done, step 2 shows how the chart will automatically display the exchange’s timezone at the bottom.

In this chart we have set the hour to “12” and the minute to “30” in the script’s inputs. The bright green bar shows when our target time is reached, and the lighter green bars show the bars where the condition we are testing is true, i.e., since we haven’t entered a specific date, the cycle repeats while our time threshold has been reached each day. You can test for either condition in your script. You can see at point 3 on the chart that the time matches “12:30”, which would not be the case if the chart’s time had not been set to the exchange’s timezone.

Coders often want to save a value on the transition to the target time. We show here how one could save the open every time the target date/time is reached. Note how, when plotting the saved value, we test for transitions when applying color to the plot, so that we do not plot any color on transitions. This prevents the inelegant steps from showing on the plot:

//@version=4

study("Detecting a specific time (in the exchange's timezone)", "", true)

targetYear = input(0, "Year (use 0 for all)", minval = 0)

targetMonth = input(0, "Month (use 0 for all)", minval = 0, maxval = 12)

targetDay = input(0, "Day (use 0 for all)", minval = 0, maxval = 31)

targetHour = input(24, "Hour (use 24 for all)", minval = 0, maxval = 24)

targetMinute = input(60, "Minute (use 60 for all)", minval = 0, maxval = 60)

targetSecond = input(60, "Second (use 60 for all)", minval = 0, maxval = 60)

// Detect target date/time or greater, until the next higher generic value (i.e., using its default value in Inputs) changes.

targetReached =

(targetYear == 0 or year >= targetYear) and

(targetMonth == 0 or month >= targetMonth) and

(targetDay == 0 or dayofmonth >= targetDay) and

(targetHour == 24 or hour >= targetHour) and

(targetMinute == 60 or minute >= targetMinute) and

(targetSecond == 60 or second >= targetSecond)

// Plot light bg whenever target date/time has been reached and next period hasn't reset the state.

bgcolor(targetReached ? color.green : na, title = "In allowed time")

// Plot brighter bg the first time we reach the target date/time.

bgcolor(not targetReached[1] and targetReached ? color.lime : na, 50, title = "Entry into allowed time")

// Save open at the beginning of each detection of the beginning of the date/time.

var float savedOpen = na

if not targetReached[1] and targetReached

savedOpen := open

plot(savedOpen, "Saved open", change(savedOpen) ? na : color.gray, 3)

// Plot current bar's date/time in the Data Window.

plotchar(year, "year", "", location.top)

plotchar(month, "month", "", location.top)

plotchar(dayofmonth, "dayofmonth", "", location.top)

plotchar(hour, "hour", "", location.top)

plotchar(minute, "minute", "", location.top)

plotchar(second, "second", "", location.top)

How can I know the date when a highest value was found?

Both highest() and lowest() have a corresponding function that can be used to get the offset to the bar where the highest/lowest value was found. Those highestbars() and lowestbars() functions return a negative offset, so we need to change its sign before using it as a value with the [] history-referencing operator.

Once we have the offset, we can use it with the overloaded version of the dayofthemonth built-in which allows it to be used with a specific time, and the time value we use is simply the time at the offset returned by the highestbars() call, with its sign changed from negative to positive:

//@version=4